THE TAG BLOG

ONLINE FRAUD IN 2022

MARCH 24 2022

DEMYSTIFYING THE THREATS AND IDENTIFYING THE SOLUTIONS

INSIGHTS FROM NOFRAUD

As the global pandemic spread mercilessly from country to country since 2019, wreaking havoc on the lives of people across the globe, online fraudsters exploited the opportunity to spread their tentacles, obfuscating the efforts of retailers and consumers alike to retain a level of normalcy through online shopping.

COVID-19 created the perfect conditions for the mass increase of e-commerce, as sick, quarantining, and those mandated to stay home by their governments steadily chose to manage their lives through their computers, rather than in-person. Yet with this paradigm shift came an expanded arena for criminal opportunists, a threat that continues today.

Online fraudsters are a creative bunch, and they are not limited by time, location or even industry. Virtually every type of online entity that accepts payments is at risk and more than ever, businesses and organizations are having to rely upon increasingly sophisticated anti-fraud measures to protect their customers and enterprises.

When we think about “fraud”, there are an array of malevolent tactics that come to mind. And when it comes to online fraud, there are several primary forms of criminality including:

- identity theft in an array of forms;

- chargeback, refund and gift card fraud;

- and malicious websites and traffic manipulations, among others.

There are even criminals who will create mirror duplicates to legitimate ads, emails and websites, and redirect traffic to their own fraudulent operations, which are developed for the sole purpose of stealing information and the hard-earned dollars of unsuspecting shoppers.

The risks to businesses run beyond immediate income losses and include reputational damage and the loss of future business from customers who have fallen prey to fraud, no longer trusting the vendor. And that’s not all. According to a recent survey, consumers who are defrauded will not only blame the seller, but the entire marketplace that hosted them in the first place. These rising threats have paved the way for the evolution and proliferation of anti-fraud software and programming.

With the goal of preventing online fraud, anti-fraud software aims to protect businesses and consumers alike. With the dizzying array of fraud tactics being employed across the web and around the world, it is no surprise that the anti-fraud products currently available reflect a variety of solutions.

Some of the more popular anti-fraud offerings focus on various protection programs that secure everything from:

- actual transactions, as in the case of false declines;

- policies, concerning what has become known as “friendly frauds”, like return or chargeback schemes;

- and account protections, that focus on preventing account takeovers, identity fraud, and automated bot attacks on online businesses.

Reducing the potential for consumer friction is key, as with commerce in general, customer service is always the priority. Especially within the online international marketplace, competition is fierce, and there will always be an alternative for a disgruntled patron.

Some of the more sophisticated and comprehensive anti-fraud providers place a strong emphasis on ensuring that the consumer experience has minimal disruption, is seamless, and speedy. NoFraud, for example, harnesses the power of data with real-time customer authentication and proprietary algorithms that combine customer inputs with third party sources to allow for analysis and instant pass-fail decisions for all the online transactions it services.

Oftentimes, companies are overzealous in their barriers and restrictions placed on authentication and data checking, so much so that the services they employ yield an unhealthy and disingenuous volume of false declines. Those in turn result in less than savory consumer experiences, and the likelihood that not only will the sales fail, resulting in lost profits, but future business will be lost as well, to say nothing about the damage of negative word of mouth spread.

ANTI- FRAUD SOLUTIONS

So, what is a business to do? According to Gartner business experts,

“Maintaining fraud rates within organizational tolerances is considered a baseline requirement for any vendor in this space... Instead, the market has become more focused on how that can be achieved while minimizing false positives and without negatively affecting user experience.”

There are several levels of protection a business might seek:

- The absolute minimum a business would be expected to do is the performance of manual reviews of all transactions. This really would only work for very small operations and is generally paired with at least another solution.

- The next level up would rely upon gateway fraud prevention settings. In this approach, systems will filter or flag transactions that meet a basic set of criteria. An AVS (Address Verification System) mismatch is an example of this, and outfits like Authorize.net, Stripe and Shopify’s built-in fraud analysis rely on this strategy.

- More sophisticated still is a solid scoring system that assigns either a numeric score or a pass/fail result based upon certain criteria. This solution allows users to create their own custom rules for assessment and is often paired with a manual review protocol. Examples of providers of this sort include Kount, Threatmetrix, and CyberSource Decision Makers.

- Yet, given the increasingly sophisticated climate in the war against cyber-fraud, the Rolls Royces of anti-fraud software will include all the above and even more – a chargeback guarantee. This top tier of anti-fraud software providers is so comprehensive and confident in its approach, that chargeback guarantees are offered upfront. Besides NoFraud, some of the other solutions in this space include Signifyd, Riskified, ClearSale, Bolt, Forter and Eye4fraud. These companies are designed to integrate with many major online merchants, and generally offer complementary services like chargeback management, manual reviews upon request or unusual activity, policy abuse prevention, user authentication, identity proofing, and frictionless rapid checkout.

STAYING AHEAD OF THE CYBER CRIMINALS

With online commerce expected to continue in popularity, even as the most devastating days of the pandemic wane, businesses and consumers must maintain their due diligence in remaining aware of and protected against ever-evolving cybercrime.

While 2022 is bringing some level of relief as economies adapt to the “new normal” and are slowly edging back towards pre-pandemic levels of productivity, those involved in online fraud continue to hone their skills, refine their tactics, expand their criminal networks, and exploit the most advanced technologies available, including:

- the Cloud;

- satellite connectivity;

- the rise of microservices and the increase in potential attack surfaces;

- and 5G technology, which allows for greater volumes of data to flow at faster rates than ever before, creating vulnerabilities too tempting for fraudsters to resist, among others.

The top anti-fraud companies understand that they cannot remain complacent, and that they must be prepared and able to pivot, evolve, expand, and remain agile in the face of consistently growing cyber-threats. NoFraud is proving just that and in recent weeks has unveiled its proprietary Decision Engine, a comprehensive triple-pronged solution that includes a robust automated fraud protection program, managed services portfolio, and secure checkout application, all backed by human oversight and intervention when required.

Only those willing and able to remain a step ahead of the online underworld will be able to meet and beat the threats as they continue in 2022 and beyond.

ABOUT NOFRAUD

NoFraud, based in New York, NY, provides e-commerce merchants with the most effective eCommerce card-not-present fraud protection (CNP), virtually eliminating card-not-present (CNP) fraud, false positives, and chargebacks. See an immediate impact on your bottom line, without manual review or training. NoFraud is the price-performance leader, with no quotas, lengthy contracts, or start-up fees. NoFraud’s team of industry experts constantly updates the system using the latest technology to meet emerging threats. It is the only commercially available service that contacts cardholders directly to verify purchases, ensuring that businesses don’t deny legitimate customers.

To learn more about how to effectively protect your online business, visit NoFraud.com.

LATEST ARTICLES

Tackling Fraudulent Returns: Survey Confirms Wardrobing as the #1 Culprit

Today, return fraud has evolved into a costly and ongoing challenge for businesses. Wardrobing, where customers buy merchandise, use it briefly, and then return it for a full refund, is particularly disruptive. Secure Authentication Brands recently conducted a survey to understand the impact of return fraud and gather insights from business leaders on their most pressing concerns. Here's what we found and how our anti-return fraud tagging solution is helping companies turn the tide.

View DetailsRevolutionizing E-Commerce Returns With an Anti-Wardrobing Tag

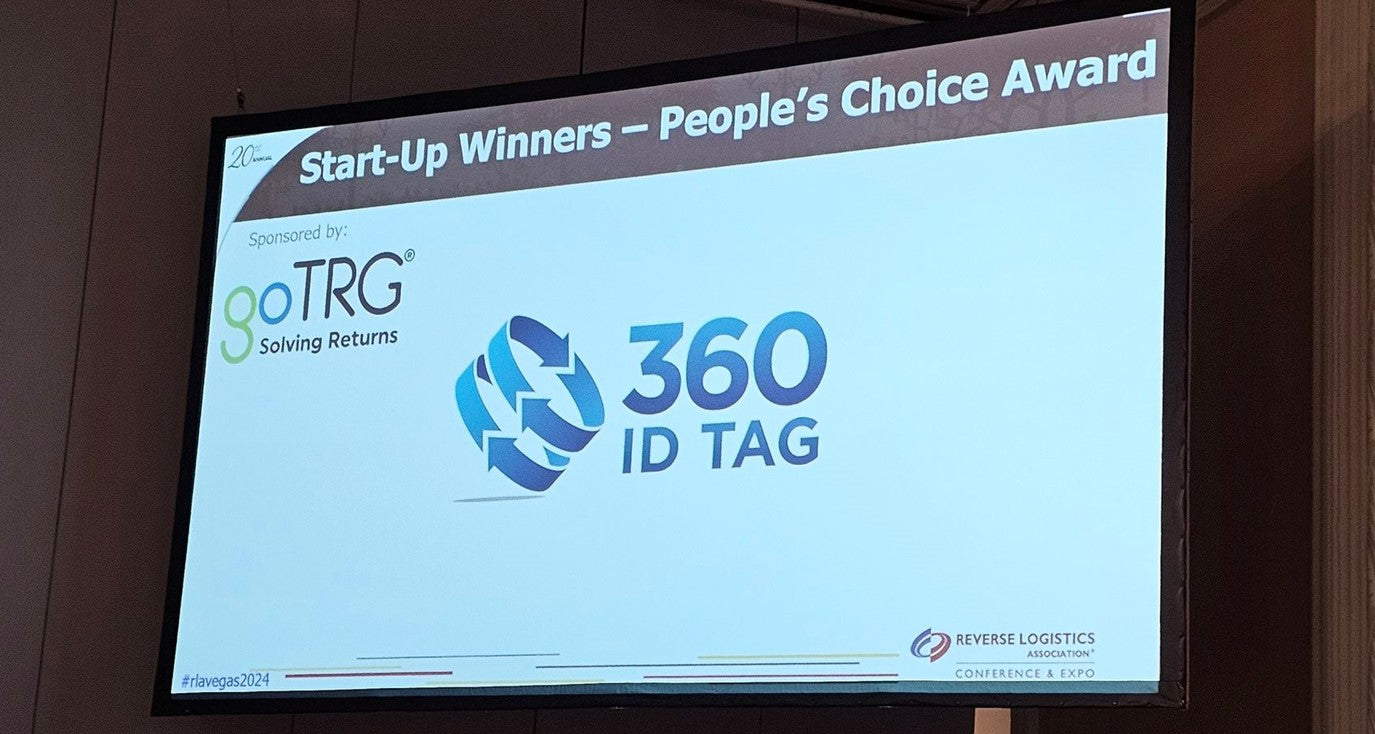

At the recent Reverse Logistics Association's 2024 Startup Competition, 360 ID Tag stood out among a field of innovative contenders, showcasing their mission to combat return fraud, specifically the insidious practice of "wardrobing." Founder Chelsea Duhs delivered a compelling pitch that resonated with both the audience and the judges.

View DetailsE-commerce's New Secret Weapon for Return Fraud Prevention

Is your e-commerce store plagued by return policy abuse over the long holiday shopping and return season? Extended return windows until the end of January and unscrupulous consumers engaging in wear and return fraud have businesses looking for solutions. Learn how to prevent wardrobing and other forms of return fraud with secure anti-return fraud tags.

View Details